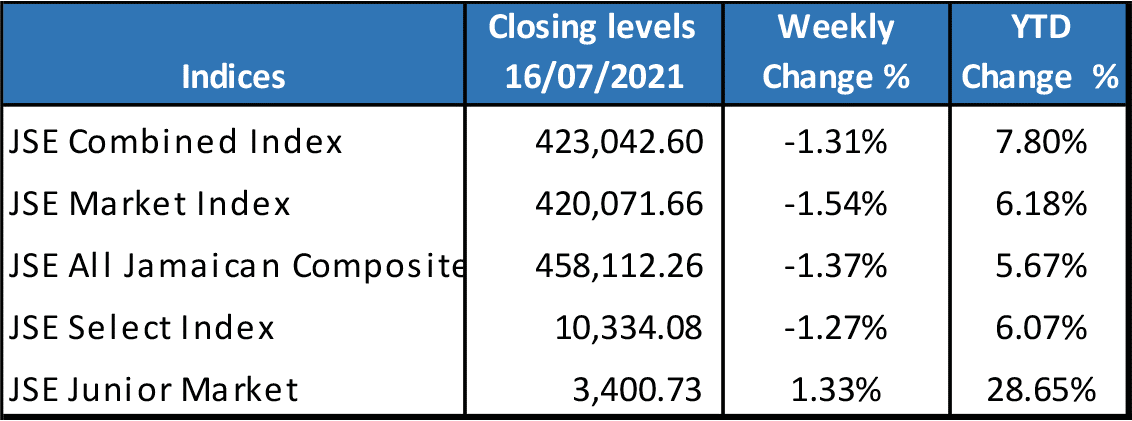

How is the Jamaica Stock Market doing?

So far this year, the Jamaica Stock Exchange (JSE) Market Index, a major stock market index which tracks the performance of all ordinary companies listed on the Jamaica Stock Exchange, has increased by almost 8%. In contrast, the JSE Junior Market index, which measures the performance of the smaller JSE listed companies, is up 28% so far this year which means the Junior market has recovered all of its Covid-19 related loss, and more.

In 2020, companies all over the world were bearing the full brunt of weaker demand for products and services and several had resorted to laying off workers or cutting back on working hours. Hence, there was a lot of uncertainty about the potential impact on company earnings when the Covid-19 pandemic risks became a major concern here in Jamaica early 2020. As a result, many investors were selling their stocks and other investments. Our local stock market experienced most of this selling pressure in March 2020, and this resulted in a sharp decline in most stock prices. Consequently, during the entire 2020 year, the local stock market index fell by 22.42 per cent, even as the Junior marked declined 21.07 per cent over the same period.

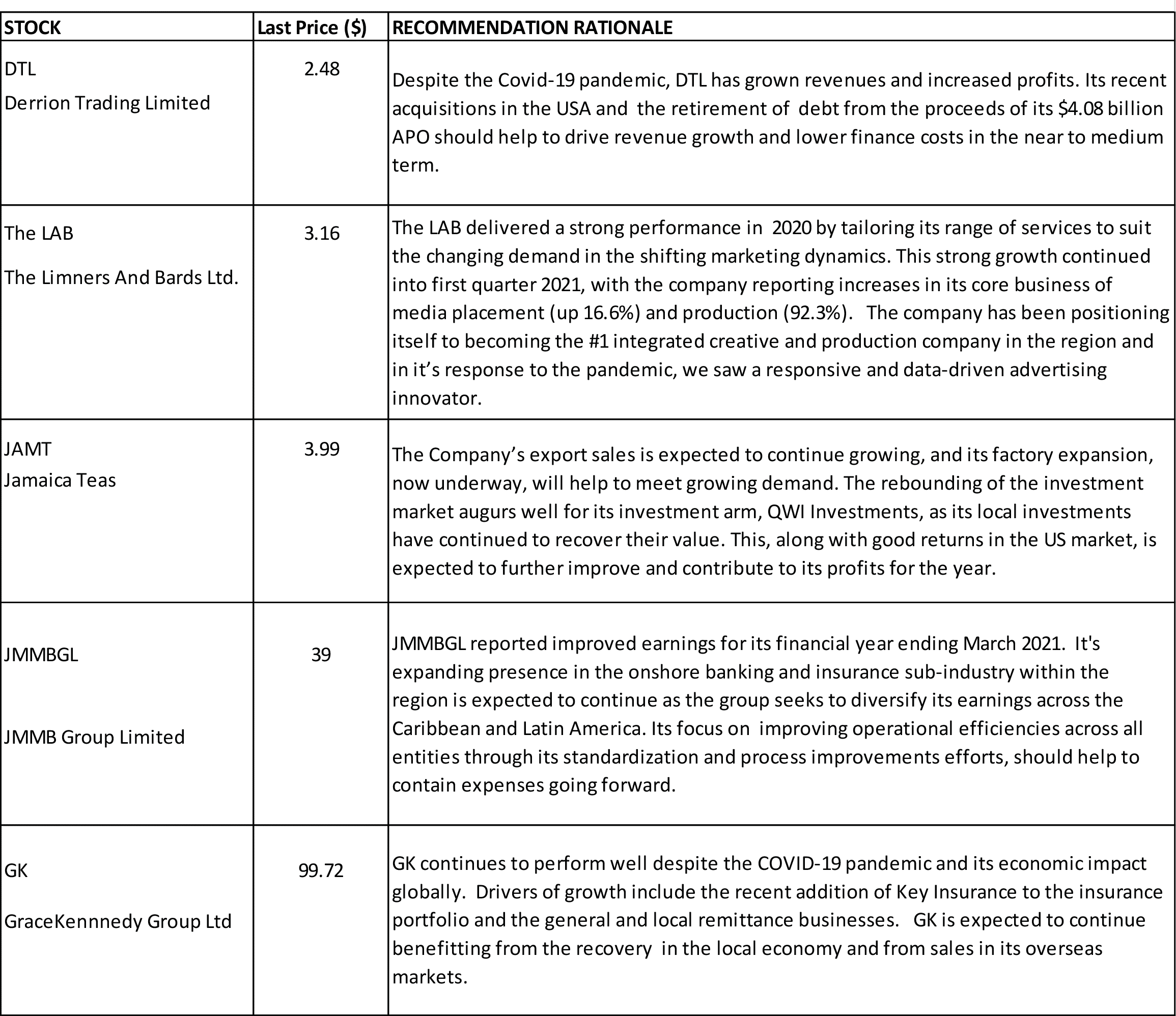

The Jamaica Stock Exchange Main Market has not performed as well as the Junior Market so far this year, due to the fall in the financial sector stocks, led by NCB Financial Group, but there are a few individual stock prices that continue to rise in 2021 and a few that possess the potential to increase even higher. However, the local banks earnings prospects in the second half of 2021 have improved, with the gradual reopening of the economy and this is expected to boost the performance of the entire stock market.